A Placemaking Journal

‘Gentrification’ Redux: Wealth, opportunity, community

It’s pretty clear that breaking news in American cities is not going to let us duck debates about race, inequality and public policy. About time, right?

Still, it doesn’t feel like we’re getting anywhere, what with partisans screaming, “You just don’t get it!” to their opposites across a wasteland of failed ideas. We seem to keep picking away at the edges of problems, focusing on sub-issues that fit our predispositions and ignoring everything that complicates our perspectives.

The right wing factions warn us against the “moral hazard” of messing with the wisdom of free markets. The lefties see a game rigged to serve the oligarchs. Debates rage; solutions stall.

Here’s the New Yorker’s Jill Lepore introducing a scathing analysis of the landscape of dysfunction in the March 16 magazine:

The reason Democrats and Republicans are fighting over who’s to blame for growing economic inequality is that, aside from a certain amount of squabbling, it’s no longer possible to deny that it exists—a development that’s not to be sneezed at, given the state of the debate on climate change. That’s not to say the agreement runs deep; in fact, it couldn’t be shallower. The causes of income inequality are much disputed; so are its costs. And knowing the numbers doesn’t appear to be changing anyone’s mind about what, if anything should be done about it.

Kaid Benfield is probably overly charitable when he characterizes elements of the dilemma as “the paralysis of imperfect choices.”

Benfield and Scott Doyon, also a PlaceMakers colleague, have engaged the general topic persuasively by focusing on what happens when we try to talk about “gentrification.” (The annoying quotes are necessary because even the definition of the word is squishy.) Benfield explores realistic policy approaches for softening the impact on less well-off residents when new money disrupts local economies and culture. Doyon, here and here, points to ironies implicit in the whole discussion and calls for a little common sense and a lot of neighborliness.

Their contributions are levelheaded and compassionate. I’m way grumpier. Here’s why:

I’m old. I grew up going to segregated schools in a city and region dominated by leaders who could be confident of business and political support by spouting inherently racist ideas, including variations on this theme:

Segregation must be maintained because it “protects” African-American communities against cultural and economic disruption and African-Americans themselves against a broader, more integrated society they aren’t “ready” for.

Remember that “separate but equal” stuff? How did that work out?

Seeing those arguments return, only this time in the mouths of handwringing liberals, is alarming. It amounts to denying low-income neighborhoods investment in the name of preserving them, a strategy no white, middle class leader would advocate for places where they live.

What’s more, it could be that rich people’s tendency to segregate themselves from the merely middle class and the poor may be a more troublesome trend than what we usually think of when we worry about gentrification. The Washington Post’s Emily Badger reviews the latest research on that topic here.

Full disclosure: I’m part of the problem — and, I hope, part of the solution.

My wife and I recently bought a cottage in Asheville. It’s in a walkable, eclectic neighborhood in a part of the city reclaimed from decay by the usual mix of artists, hipsters and small-scale entrepreneurs. Now, similar to the cycle of neighborhood redevelopment Scott Doyon outlines in his post, our future community has evolved from a destination for the “risk-oblivious” to one for the “risk-aware.” By the time we move, it may have reached the climax stage of being a comfy place for the “risk-averse.”

There are the familiar tensions in the transition in Asheville: While some older residents are cashing in on the rise in property values and business opportunities, others can no longer afford to live in their old neighborhood. Damn those hipsters, no?

And there are the increasingly familiar ironies: Our new home is currently rented by a couple of young professionals, Millennials, whom original residents would likely see as part of the gentrification wave. When we retirement-aged Boomers move into our house, we’ll be forcing them out into an environment of less affordable rents and less convenient locations. Damn those 401K-enabled geezers, no?

And so it goes.

What’s happening in Asheville and in other cities where the appeal of urbanity is driving redevelopment is a refutation of the idea of a city or a neighborhood as a static environment. A city, as Jane Jacobs famously reminded us, is a living thing, growing, dying, changing all the time. Doyon nails the current change-drivers:

Fueled by the demographic bulk and emerging urban sensibilities of both the Baby Boomers and the Millennials, American cities — and city neighborhoods — are finding themselves increasingly attractive to outside investment. Not necessarily because they’re affordable (in many areas, that ship has sailed) but because they deliver the things people are looking for — walkable, car-lite or car-free convenience, neighborhood schools, and architectural charm to name but a few.

Right now, the increasing appeal of urban amenities is powering a market that will trump most efforts to shield those without the means to adapt to — and maybe even profit by — the market’s effects. Wouldn’t it be better, then, to direct policies towards expanding the adaptive capacities of those in the paths of inevitable change rather than wasting time and resources resisting the inevitable?

Which gets us to a discussion about what we know about adaptive capacities. In a word, it’s wealth.

That doesn’t necessarily mean the wealth acquired by the one-tenth of the one-percent of the U.S. population. It just means resources in reserve to overcome unexpected setbacks and to invest in a future. For a family, wealth translates to having enough to not only handle day-to-day expenses and time-to-time emergencies, but also to set aside money for a house down payment or to save for children’s education or retirement.

Talking only about income inequity makes it too easy to focus narrowly on jobs. You can have a job and still not be able to build wealth. In fact, that’s the case with most people in poverty in America. They’re one lay-off, one illness, one broken-down family automobile away from losing everything. (For a solid round up of the wealth/income inequity discussion, see Tanvi Misra’s “CityLab” blog post, complete with charts, from last month.)

An inability to accrue and leverage wealth is a severe disability when it comes to participating in America’s economy and society. That’s never been more true than today, when those with superior education, professional networks and access to resources can better position themselves for opportunities and better indemnify themselves against risk.

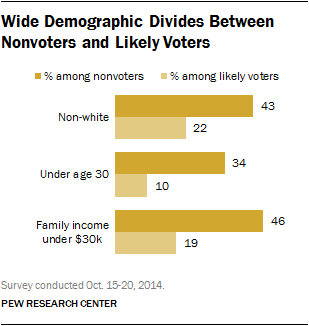

Not surprisingly, those with wealth to protect are incentivized to defend and perpetuate their advantages. Older white people with higher education and income levels are more likely than younger, poorer, less educated minorities to vote and to contribute to political campaigns.

Which means elected officials, responding to those who elected them, are inclined towards policies that subsidize wealth building and wealth protection. Such as: tax advantages for investment income, for first and second home mortgages and for transferring accumulated wealth to the next generation.

There’s nothing inherently nefarious going on. Especially if you hold sacred the notion of the primacy of the individual and look with suspicion upon appeals to “the common good.” Government — and by extension, taxes — are never at the top of Americans’ faves lists. Even less so these days. Which is why the taxes that people don’t pay aren’t thought of as threats to the American way of life, compared to government “handouts” to the less wealthy — even though dollars saved or awarded have the same value.

There’s an unfortunate irony here in that both the wealthy and the poor behave rationally from their own points of view; and by acting on their reasoning, they increase the odds that they’ll continue being rich or poor. The wealthy, trusting they can influence policies and programs, invest time and resources in doing that. And they get richer. The poor withhold their trust and participation in a system that mostly serves the wealthy and ignores them. And sure enough, that’s what keeps happening.

This is depressing. But it’s also unsustainable. We have plenty of evidence that excluding more and more people from meaningful participation in the economy and culture is not only morally reprehensible, it also increases the costs of maintaining the economy and the culture.

Things fall apart. Literally, in the case of transportation infrastructure, but also when it comes to education, health and other services counted on by the diminishing middle class as well as by the poor. We seem to be drawing closer to that awareness in governors’ and mayors’ offices, if not in Congress.

Despite our precious mythology of individualism, change will be policy-driven, just as the inequities built into the system have been policy-driven. And those policies, at least at first, will avoid the nasty debate over “handouts” and racial preferences by embracing wealth-building opportunities for all at scales beyond the household or even the neighborhood.

More and better jobs? Sure. But not every job is the same. Low-paying work that requires long hours and long commutes inhibits responsible parenting and depletes savings that build wealth.

More affordable housing? Sure. But subsidized rents alone enable only marching in place. And badly designed, badly located public housing that further isolates and stigmatizes struggling families is a step backward.

We grew this wealth gap by allowing a mix of bad ideas to coalesce into something bigger and more troublesome than the sum of its parts. And we need a more integrated approach to narrow it.

Broader transportation options (especially the self-propelled kind), dignified housing, high-performing schools, quality childcare, affordable healthcare, access to healthy food and exercise: We know amenities like those build tax bases and community wealth in infill urban areas and in close-in ‘burbs with quality bones. Wealth generation, after all, is the upside of gentrification. But right now, we’re allowing the price for those advantages to be bid up to a level that only a narrowing percentage of families can pay and still build wealth. Why not invest in strategies that capture that value in more equitable ways? Why not spread out the costs community-wide?

Heard this before? Absolutely. It’s just that up until now, the sense of urgency and the political will to move rules and money around were lacking. These days, everybody’s seen numbers like the ones in this recent Urban Institute analysis. Between 1963 and 2013, says the Urban Institute report:

- Families near the bottom of the wealth distribution (those at the 10th percentile) went from having no wealth on average to being about $2,000 in debt.

- Those in the middle roughly doubled their wealth—mostly between 1963 and 1983.

- Families near the top (at the 90th percentile) saw their wealth quadruple

- And the wealth of those at the 99th percentile—in other words, those wealthier than 99 percent of all families—grew six fold.

And the political will?

America’s changing demography is bound to have an influence. The combined 150 million Millennials and Boomers have within their populations voters unsettled by the diminished choices they have in their different stages of life. Many feel priced out of opportunities for full community participation as aging citizens or as career and family-launching young people. And they may not be as motivated as the current electorate to continue skewing government policy to benefit those who’ve benefitted the most over the last couple decades.

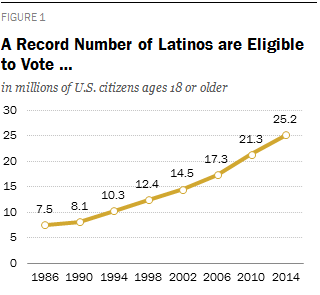

Add to that the coming of age of another huge demographic bulge — Latino Americans.

Democratic Party candidates and their traditional constituencies seem the most likely to be open to policies calculated to narrow the wealth gap. And though the last electoral test – the 2014 mid-term elections — was devastating for most Democrats, “in congressional races nationally,” says the Pew Research Center, “Democrats won the Latino vote by a margin of 62% to 36%.”

–Ben Brown

If PlaceShakers is our soapbox, our Facebook page is where we step down, grab a drink and enjoy a little conversation. Looking for a heads-up on the latest community-building news and perspective from around the web? Click through and “Like” us and we’ll keep you in the loop.